Residents Encouraged to Review Taxable Value, Check for Tax Relief Eligibility

FAIRFIELD COUNTY – As Fairfield County residents receive this year’s property tax and reassessment notices, many are asking why their property taxes have changed.

Some increases come from new millage rates while others are linked to reassessed property values.

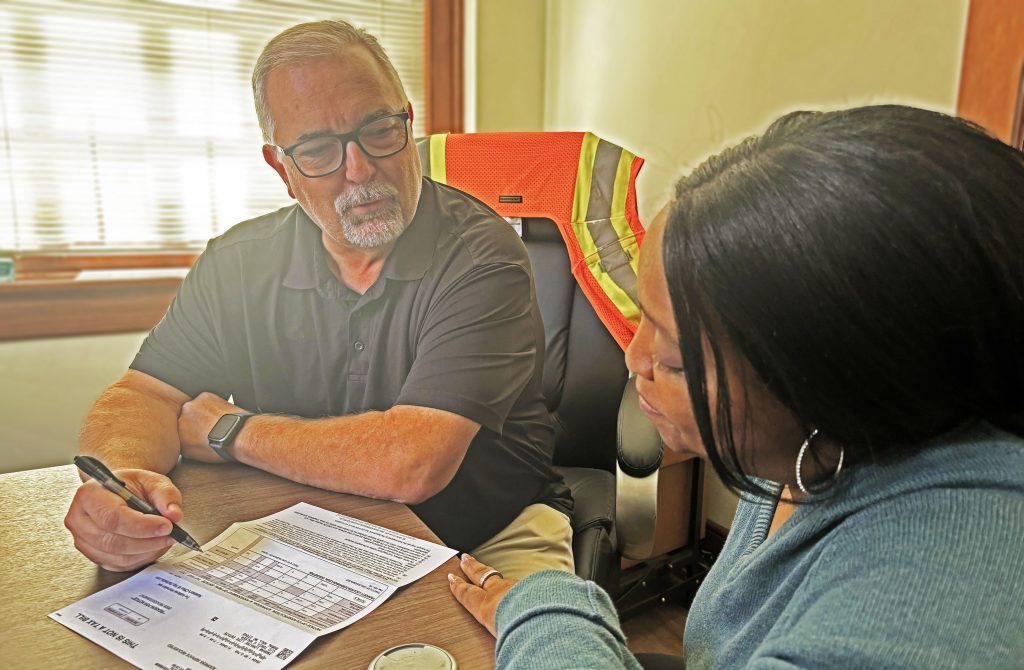

County Auditor Anne Bass and Assessor Guerry Hensley sat down with The Voice to help residents understand what is driving the changes and to remind homeowners that many may qualify for the state’s Homestead Exemption.

Bass said tax notices are scheduled to be mailed by the end of the week. She explained that both the county and school district adjusted their millage rates this year, with three mills added for school operations (which are not paid by owner occupied homes/legal residences) and eight mills for county capital projects. Some municipalities also used local tax options that affected their totals.

The Effect of Millage Increase

A mill represents one dollar in tax for every one thousand dollars of assessed property value. How that translates to your bill depends on the type of property and its assessed value. For example, a typical legal residence with a market value of $100,000 has an assessed value of four thousand dollars; this year’s county millage increase will add about thirty-two dollars to that tax bill. A legal residence with a market value of $200,000 would see that increase rise to sixty-four dollars. The same two homes, not qualified as a legal residence, would see the tax increase rise to $66 and $132 respectively. Breaking it down this way shows how even small changes in millage or assessed value can affect what you pay.

Reassessment

Hensley explained that 2025 marks the county’s regular five-year reassessment cycle. The last reassessment was completed in 2020. In reassessment, property values are based on sales across the county, with more weight given to recent years.”

Legal Limits

He said millage increases are also limited by state law. Under South Carolina’s Assessable Transfer of Interest Law, often called the ATI Law, taxable value can only increase by a maximum of 15 percent unless a property changes hands or has major improvements.

“If your home was valued at $100,000 in 2020 and is now worth $200,000, the most you can be taxed on is $115,000,” Hensley said.

Both offices emphasized that residents should focus on one key number.

“The most important thing to look at is your taxable value. That is what determines what you pay,” Hensley said.

Appealing Tax Bill

Bass added that residents have ninety days from the date on their notice to appeal if they believe an error has been made. Appeals begin with the Assessor’s Office.

Beyond the appeals process, both officials urged residents to learn more about the Homestead Exemption, which provides significant property tax relief for eligible homeowners.

Homestead Exemption

The exemption applies to those who are either 65 or older, totally and permanently disabled, or legally blind, and who have lived in their home as a legal residence for at least one year. It exempts up to $50,000 of the home’s fair market value from property tax.

Bass said she believes many residents who meet those qualifications have not applied for the exemption and are paying more than they should.

“We have residents paying full taxes on homes that qualify for the Homestead Exemption,” Bass said. “It is worth calling our office to check because it can make a real difference.”

The application process is simple and handled through the Auditor’s Office. Residents should bring a driver’s license or state ID showing their current address and any documentation proving disability or age eligibility. Once approved, the exemption remains in place as long as the homeowner continues to live in the residence, Bass said.

The Homestead Exemption was created by the state legislature in 1972 to help protect older and disabled South Carolinians from being taxed out of their homes as property values rise. The program now assists thousands of households across the state every year. In Fairfield County, officials say they hope more residents will take advantage of Homestead Exemption, particularly as reassessments adjust taxable values.

Hensley added that even with the ATI Law’s 15 percent cap, some homeowners may notice modest increases because of overall market trends and local millage adjustments.

“Values are based on sales data from across the county over the past five years,” he said. “The trend is up.”

Both the Auditor’s and Assessor’s Offices encourage residents to reach out early if they have questions or concerns. Those who wish to appeal their reassessment should file within 90 days of the notice date.

Questions?

Questions about exemptions and millage rates, should go through the Auditor’s Office. Reassessment or property value questions should be directed to the Tax Assessor’s Office.

Residents can call, email, or stop by either office for assistance. Staff members are available to explain how reassessments work, verify Homestead Exemption eligibility, and guide property owners through the appeals process.

While this year’s reassessment and tax notices have sparked questions throughout Fairfield County, local officials say the process is meant to remain fair and transparent.

“Understanding how millage, taxable value, and exemptions fit together can help residents take control of their tax bills and ensure they receive every benefit they qualify for,” Bass said.